Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

The shipping industry is breathing a much-needed, collective sigh of relief after an extremely hectic q1. All is now quiet on the western front... for now.

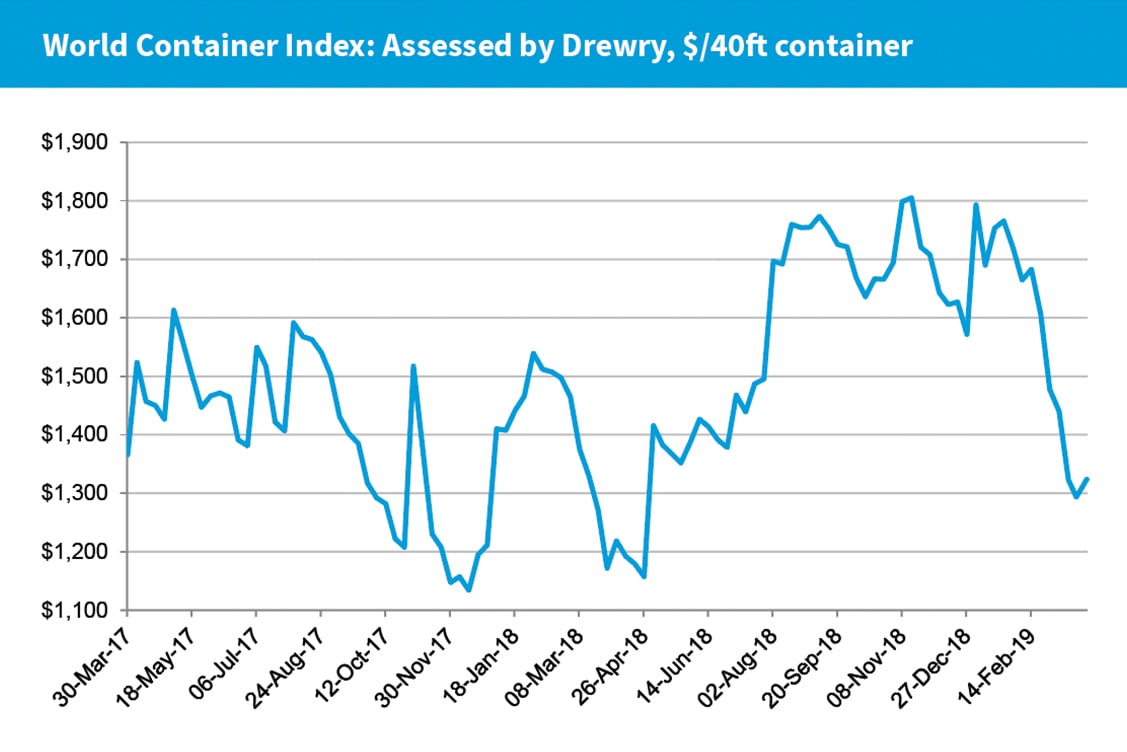

There are a few lasting unknowns pertaining to trade negotiations, tariffs, and carrier consolidation, but these industry issues are mere anthills compared to the mountainous build-up of containers at U.S. ports during the several months between President Donald Trump’s $250 billion tariff announcement on Chinese goods last September and the start of the Chinese New Year this February, when shippers scrambled to get ahead of the new measures, while traditionally rushing to get orders out in preparation for the prolonged shutdown of many Asian factories and businesses.

Those entangled in the ensuing port congestion were subject to an astounding amount of associated charges, due to increased wait times and carrier rate inflation. Eventually, one of two things will happen: either costs incurred by shippers will be passed to consumers, or we’ll see companies lower earnings, because they’re holding inventory. Any further economic effects will likely become clearer in Q3, though there are several reasons to be optimistic about the overall health of global trade.

Thus far, the U.S. trade war with China has slowed down the latter’s economy, affecting global economic growth. We are not experiencing any heightened threat from an inflation standpoint, however, which suggests the downward momentum is symptomatic of the Trump administration’s trade practices rather than the end of an economic cycle. So, while the slowdown is indeed very real, low unemployment and a low-interest rate environment should help to dispel recession-related anxiety.

Much will depend on the timing and parameters of an anticipated resolution or compromise in U.S.-China economic relations going forward. It is likely the demands of the electoral cycle will lead the two to an agreement rather than further escalation.

As always, we will continue to monitor the situation and provide extraordinary freight forwarding and logistics services to our clients, no matter the seas ahead.

From 2014 to 2015, a longshoreman strike halted trade at nearly 30 U.S. ports along the Western Seaboard. Lasting about three months, the work stoppage resulted in hundreds of vessels stalled just off the coast for its duration. Once ended, it took dockworkers six months to get back on track.

This congestion was a walk in the park compared to what happened after President Trump’s tariff announcement at the tailend of 2018: In anticipation of its implementation, and with trepidation over threats of an even further escalation, cargo volumes from China skyrocketed. Consequently, there simply weren’t enough boats or resources—human or technological—at East and West Coast ports.

For context, even in a congested port, it normally doesn’t take truckers more than four days to retrieve a container. This time around, between the ports being ill-equipped to handle such capacity, the curtailment of trucking fleets, and a severe shortage of chassis, truckers couldn’t get containers out of the port for 10 to 15 days post-delivery orders. Such havoc created an average charge of $3,000 per container in demurrage—costs incurred by shippers when a container is left unloaded at a port for longer than the allotted grace period—for every forwarder.

The proposed automation would serve a section of the port devoted to working reefer containers—refrigerated containers used for transporting perishables.

The future may be very limited, in terms of carrier selection. There will be several major carriers likely dominating the entire industry, potentially resulting in a very negative impact on freight forwarders.

The frenzied dash among shippers in anticipation of Trump’s tariff deadlines (in January 2018 and March 2019), the associated chaos, and subsequent drop off in volumes, all helped to ensure that the first quarter would be nothing like the fourth quarter. As we approach May and June, the market will look healthier.

Unless President Trump makes another serious announcement, people probably won’t flood to ship inventory ahead of schedule again. It was a false market. It doesn’t look like he’ll be announcing anything soon, so the normal trend of the market will take over and what will happen is, by late March/April, it will begin to uptick a little bit.

Following Chinese New Year on February 5, cargo volumes at the Port of Los Angeles started to dwindle, spurring an onslaught of cancellations. We predicted as much, knowing that the 30- to 60-day production cycle would begin anew for all shippers who frontloaded inventories ahead of schedule.

The U.S. trade war remains the most important issue in both economists’ and shipping professionals’ minds.

Trade War Tensions

There was a drastic increase in cargo traffic through December and into January, primarily driven by an attempt to avoid tariffs. The subsequent slowdown was affected by shipments being finalized before the feared additional tariffs dates, and also by the slowing of the Chinese economy.

Economic Slowdown

The global economy was in very good shape until the Trump administration decided to start trade wars with the rest of the world. The U.S. trade war with China slowed down China’s economy, affecting global economic growth.

Commodities

The potential for flat or even lower interest rates in the United States and several other developing nations is likely to help many commodities-dependent emerging markets and developed countries with large commodity exposure, like Australia.

New NAFTA

The new NAFTA [North American Free Trade Agreement], or the USMCA [United States Mexico Canada Agreement] has not yet been ratified by politicians operating in a gridlocked Washington.

Recession

Economists are infamous for predicting 20 of the last five recessions, and those who claim to have success in predicting a recession are usually predicting one all the time.

Growing Deficit

Worrying about the trade deficit is a basic misunderstanding of the economy and global trade. The higher trade deficit for a consumption-oriented country like the United States (and the vast majority of developed nations) is a reflection of increased demand usually due to stronger economic growth. A higher trade deficit is typically something positive for the U.S. economy.

The Devalued Dollar

The expectation of a large decline in the U.S. dollar is somewhat overblown. We are not in a “normal” economic environment. The economic slowing, while real, is a side effect of bad policies. It is likely that some of those policies will be changed as we get closer to the elections, when politicians become more desperate for strong economic growth.

Brexit

We have to consider potential effects of Brexit. The impressive lack of leadership and competency of U.K. politicians is probably making the rest of Europe grow quite fond of the idea that the U.K. may soon be leaving the European community, but nothing seems to be clear on that front, either.

CAF was founded in 1982 with a vision to be an industry leading, full-service logistics provider.

Over the years we have weathered changes in the global distribution landscape by focusing on exemplary customer service and retention that is unparalleled in the freight forwarding industry.

Through the use of technology, experience, and highly trained personnel we provide our customers with the highest level of service and supply chain solutions. Our complete dedication to excellence has remained constant ensuring that our focus on providing the absolute highest quality service to our clients is never diminished.

100 Jericho Quadrangle,

Suite 233

Jericho, New York 11753

516-444-3700