Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Why it’s vital to stay positive within this volatile market.

As we bring you our latest CAF Quarterly Forecast, we’re in the midst of many industry changes. This affects everyone from carriers, truckers, ports and factories, to of course freight forwarders and logistics providers.

While these continue to plague our industry, it’s seemingly a Herculean task to stay positive and hopeful. At CAF Worldwide, we hope this Quarterly Forecast will ease some of your concerns— better days will soon be on the horizon.

We’ve always banded together during disruptive events, such as the Great Recession and the Port of Los Angeles and Long Beach strikes.

We’ll make it through this as well.

This edition is focused on the apparel industry. While things might seem uncertain, the worldwide apparel market will still achieve high numbers. According to online data statistics portal Statista, this figure is set for value of $1.52 trillion in 2020.

Most demand will continue from Asia. As China becomes more costly to do business, alternative nations, such as Vietnam and Bangladesh will continue to move ahead.

The aforementioned figures represent how the apparel industry can still make a solid comeback from prior economic events. I am hopeful we’ll see the same gains as current events even out.

These sentiments are echoed by some of the top thought industry leaders mentioned in our apparel report.

As a value-add, Jeffrey Orenstein, a transportation and trade attorney with Washington, D.C.-based K&L Gates, provides legal insights on apparel’s current challenges. Our newest section features apparel industry thought leader commentary discussing what to expect going forward.

And last, but certainly not least, our regular Trade Lane Notes report is provided by CAF’s longtime director of operations.

Thank you for supporting CAF Worldwide. Please reach out for any supply chain needs and questions. We will always be here for you, our valued customers and friends.

With the apparel industry undergoing constant change, it’s hard to see the light at the end of the tunnel. Despite challenges, such as Chinese tariff increases and the Coronavirus Disease 2019 (COVID-19) pandemic, the industry could still rebound later in the year, with cautious optimism.

According to the U.S. International Trade Commission,: “The value of U.S. imports of textiles and apparel rose by $6.3 billion (5.2 percent) to $127.7 billion in 2018. U.S. imports of textiles and apparel consisted principally of apparel (72 percent of total imports), which experienced the largest increase in value from 2017 by far, rising $3.8 billion (4.2 percent).”

The Apparel Industry will have a forever-changed landscape following events such as tariff increases and the Coronavirus pandemic.

With the apparel industry undergoing constant change, it’s hard to see the light at the end of the tunnel. Despite challenges, such as Chinese tariff increases and the Coronavirus Disease 2019 (COVID-19) pandemic, the industry could still rebound later in the year, with cautious optimism.

According to the U.S. International Trade Commission,: “The value of U.S. imports of textiles and apparel rose by $6.3 billion (5.2 percent) to $127.7 billion in 2018. U.S. imports of textiles and apparel consisted principally of apparel (72 percent of total imports), which experienced the largest increase in value from 2017 by far, rising $3.8 billion (4.2 percent).”

While not trying to downplay the current economic and health statuses, there are solutions shippers can employ to weather this storm. This includes looking at alternatives due to the 2019 tariff wars.

“The U.S.-China trade war and impact of the Coronavirus, not to mention more rapidly changing consumer preferences, supply chains are shortening and production lead times are being reduced. This means that dependence on countries considered high risk is being reduced, sourcing is being diversified, and where possible, is brought closer to end markets,” says Peter Tirschwell, Vice President, Maritime & Trade, IHS Markit.

Even after production resumes to a sense of normalcy following COVID-19 and tariffs, the apparel industry will have a forever-changed production landscape.

“Both [tariffs and COVID-19] will indelibly change the supply chain forever. Retailers and brands have had close to a year to react to the tariffs and many have changed production to areas like Latin America and other Asian countries outside of China,” says David Weinand, Chief Customer Officer, Incisiv, Inc. This is one layer shippers can add to lessen the brunt.Implementing new supply chain processes and technologies is another

value-add.

“Information and technology are becoming core to logistics providers,” he continues. Those that make the investments to create customer value in areas like cargo visibility will create lasting value and secure customer relationships; those that don’t invest or can’t due to lack of scale will be increasingly challenged.”

Perhaps the current situation is a lesson learned for not just apparel, but all industries. According to Jordan Speer, Research Manager, IDC Insights, agile, resilient supply chains have been discussed for the last several years, and as COVID-19 has demonstrated, most supply chains are far from where they should be.

“To prepare themselves for future widespread supply chain disruptions, apparel companies will need to develop supply chains that are not only more resilient but also more diversified,” Speer says. “Today, a large number of brands have their operations concentrated in China. A strategy that spreads manufacturing across many regions and factories in China is not sufficient.”

COVID-19 is already changing how people work, and it will also alter how people manufacture and shop. Products will still need to move, and freight forwarders will be the game changers. According to Speer, supply chains have many more facets.

“Logistics should no longer be thought of as a cost of doing business, because it’s not. It is a competitive differentiator. The ability to deliver product on time, to the destination of choice, in a manner pleasing to the customer so that the entire experience is a delight, is a large part of what customers are paying for today,” Speer says. “It’s not just about the product. At a time like this, freight forwarders and logistics providers have an opportunity to shine and earn customer loyalty by helping fashion companies and other businesses get out of the jam they’re in.”

Apparel industry thought leaders provided original commentaries for the CAF Worldwide Quarterly Forecast, about what they’ve been experiencing, hearing and seeing within a daily changing industry.

Learn more to hear their responses to the following question:

We’re at the end of the first quarter. What is your overall industry outlook for the next few quarters?

Ashley Craig

Co-Chair, International Trade and Logistics Group, Venable LLP

“The closest I’ve seen to our current situation was in 2008-2009 during the Great Recession. We were previously at 2016 levels, but now every single increase has gone down, and we need to take the long view. I don’t think anyone believes even half a sense of normalcy at the end of March. We’re looking at this being the situation of the new normal through April and into May. I’m looking at Hong Kong and China, it hasn’t been six months—it’s been four to six weeks. They have taken decisive action and are seeing a shift and a pivot. So why would we be any different?”

Jeffrey Orenstein

International Trade and Transportation Lawyer,

K&L Gates LLP

“The apparel industry has been delivered a double blow with the coronavirus— COVID-19—on the one hand, creating logistics bottlenecks, and elevated sourcing costs out of China, on the other hand, due to heavy tariffs on apparel. The American Apparel & Footwear Association joined numerous other business associations urging President Trump to consider emergency measures to mitigate the economic harm of COVID-19 by suspending tariffs against Chinese-origin goods and other tariffs paid by U.S. importers.”

V. Ann Paulins

President, International Apparel and Textile Association

“The Bear Market is a major influencer for retailers and apparel/textile manufacturers right now. The stock market, coupled with the timing of 2020 being an election year, leaves uncertainty in the minds of consumers as well as business leaders. It is a time that consumers are likely to feel uneasy about spending money—and they will be inclined to focus on basic needs, including supplementing savings if possible, rather than spending on the ‘frivolity’ of fashion.”

Jordan Speer

Research Manager, IDC Retail Insights

“It’s tough to predict how the next several quarters will pan out, because so much depends on the progression of COVID-19 through the population and the devastation it wreaks. IDC has set forth three scenarios—optimistic, probably and pessimistic. The probable scenario, put forth several weeks ago, suggests impacts on supply chain and economy well into Q2. But as more time passes, we are moving farther from probable and closer to the pessimistic, which predicts, among other things, factories finally getting back to full capacity in June. With the pessimistic scenario, the outbreak lasts longer than expected, continuing into the Q3 of the year, with travel control measures also not lifted until then.”

.jpg?width=87&name=Tirschwell_Peter2016%20(1).jpg)

Peter Tirschwell

Vice President, Maritime & Trade,

IHS Markit

“The economic crisis due to the coronavirus is deepening in the U.S. and worldwide. It is not clear how severe the economic impact will be, but the potential for economic damage is very real. According to IHS Markit, ‘This is both a demand-side shock—with damage to travel, tourism, and any activities involving large crowds—and a supply-side shock, with major disruptions to supply chains. Some have referred to the supply-side effects as a ‘human credit crunch.’ This will be a U-shaped rather than V-shaped cycle, with a sharp reduction in growth, followed by slow recovery.”

David Weinand

Chief Customer Officer,

Incisiv, Inc.

“Unfortunately, I believe the industry is in for an extremely rough year, not just one to two quarters. It is likely that the consumer psyche will be forever changed, or at least changed for one to two years, as this pandemic plays out. In the short term, consumers will revert to the most basic level of Maslow’s Hierarchy of Needs, and that will not be that new blouse or pair of designer shoes.”

Despite current obstacles, international trade will thrive due to alternative countries of production and free trade agreements.

One of the greatest challenges facing the apparel industry is the high duty rate for U.S. imports. Section 301 tariffs against Chinese imports continue to plague the apparel companies, notwithstanding the Phase One Trade Deal reached with China earlier this year.

These tariffs raise costs for Chinese imports, such as: apparel (92 percent); footwear (53 percent); home textiles (68 percent); and all travel goods and accessories.

In addition to a significant tax on U.S. apparel commerce, they directly impact an estimated 4 million U.S. workers, as well as U.S. consumers.

Most Section 301 tariffs are expected to remain in 2020. This is based on the current trade talks’ trajectory and the next administration.

Beyond China, there may be positive developments to import duties arising from other trade deals at various negotiation stages. The newest pertains to Kenya—the 20th-largest supplier of apparel to the U.S. market by volume.

A formal announcement that the U.S. plans to enter trade negotiations with Kenya is expected. This is due to subsequent Capitol Hill meetings with U.S. Trade Representative (USTR) Robert Lighthizer. Talks could commence this June following Rep. Lighthizer’s notification to Congress.

The American Apparel & Footwear Association has welcomed a potential free trade agreement. This would broaden opportunities for United States- and Kenya-based businesses, workers, and consumers.

There’s an optimism wave regarding Brazil. Following a meeting between U.S. President Donald Trump and Brazilian President Jair Bolsonaro, the White House said the leaders will accelerate efforts to produce a 2020 trade package. Although trade officials from both countries have been instructed to work toward completion of such a deal, it isn’t clear whether it will address the duties both countries impose on apparel, leather, and related goods.

Progress has been slow in European Union (EU) trade negotiations. Part of the United States’ proposed EU trade agreement is comprehensive duty-free treatment for textiles and apparel products.

According to international news organization Reuters, EU Trade Commissioner Phil Hogan said: “The European Union and United States are taking slow, small steps toward a ‘mini’ trade deal.”

There appears to be the political will in the EU to address difficult issues that have previously complicated the U.S.-EU trade relationship, such as agricultural and auto tariffs. It’s also unlikely the Trump administration will soften its hardline prior to the U.S. presidential election.

The aforementioned trade negotiations are a naturally slow process. Adding the challenges of the coronavirus pandemic will undoubtedly affect final decision timing. Given the Trump administration’s trade focus, the apparel industry should experience albeit minor developments, signaling greater things to come.

Jeffrey Orenstein is an international trade and transportation lawyer in the Washington, D.C. office of K&L Gates, LLP.

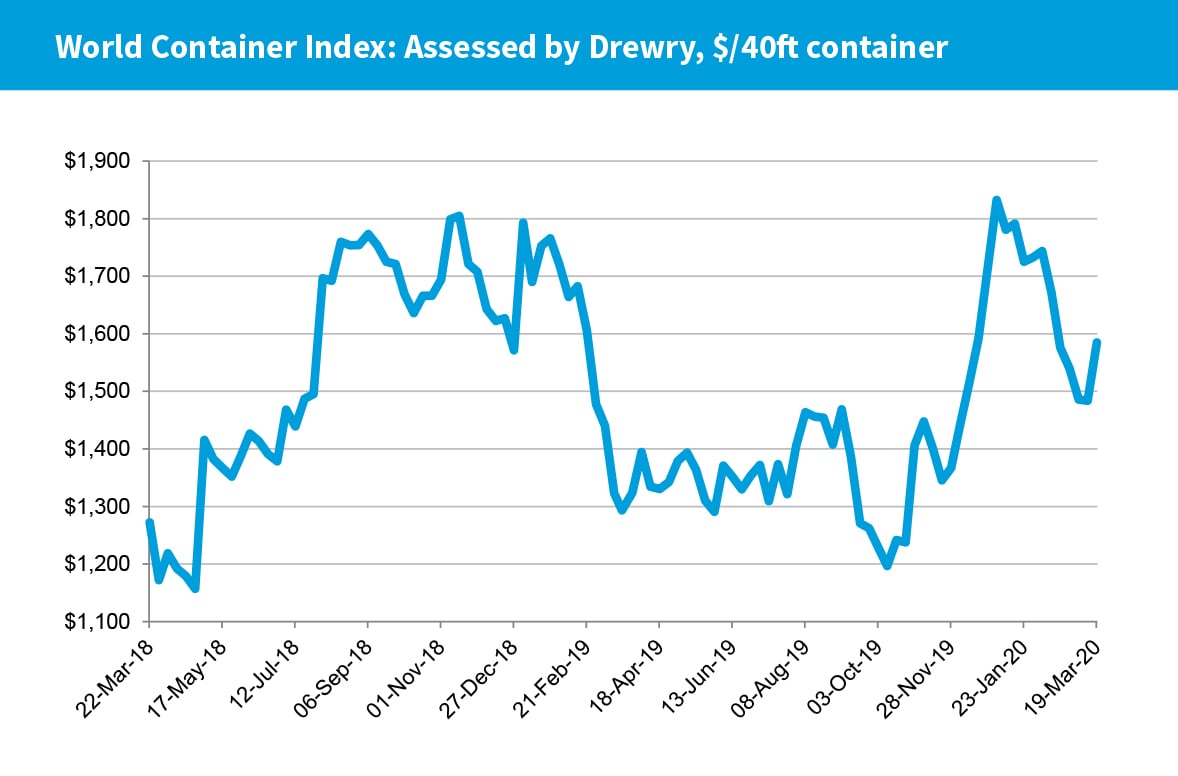

Low inventories resulting from extended Chinese New Year, Coronavirus Disease 2019 (COVID-19) and blank sailings continue to plague the industry.

The apparel industry continues to experience production delays, blank sailings and transportation delays due to the current health and economic environment. Working with an experienced freight forwarder can help alleviate this through careful contingency planning.

These have affected the shipping and apparel industries on all fronts. This includes production schedules, orders received and factory shutdowns.

Note the following:

Per the last CAF Quarterly Forecast, blank sailings are up. According to The Journal of Commerce (JoC), last year there were “253 (blanked) sailings in the east-west lanes compared with just 145 skipped voyages in 2018.”

Per the last CAF Quarterly Forecast, blank sailings are up. According to The Journal of Commerce (JoC), last year there were “253 (blanked) sailings in the east-west lanes compared with just 145 skipped voyages in 2018.”

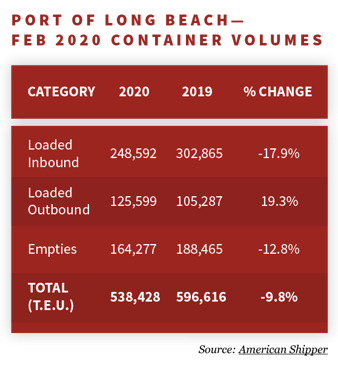

As a Chinese import-export hub, the Port of Los Angeles is experiencing some of the strongest decreases due to current economic conditions.

According to American Shipper: “Fewer ship calls in the midst of the coronavirus pandemic as well as lingering effects from the United States’ trade war with China resulted in a 17.9% year-over-year drop in imports at the Port of Long Beach in February.”

It’s also affecting intermodal transportation. Many trucking companies serving this port have experienced losses. Some have been forced to close down.

Moderate to massive production and transportation delays will continue. This includes ocean, intermodal and airfreight transportation. Skipped sailings will continue to show their effects, with delayed cargoes and decreased capacity. It’s recommended to add at least one week to current shipment estimated arrival times.

CAF was founded in 1982 with a vision to be an industry leading, full-service logistics provider.

Over the years we have weathered changes in the global distribution landscape by focusing on exemplary customer service and retention that is unparalleled in the freight forwarding industry.

Through the use of technology, experience, and highly trained personnel we provide our customers with the highest level of service and supply chain solutions. Our complete dedication to excellence has remained constant ensuring that our focus on providing the absolute highest quality service to our clients is never diminished.

100 Jericho Quadrangle,

Suite 233

Jericho, New York 11753

516-444-3700