Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

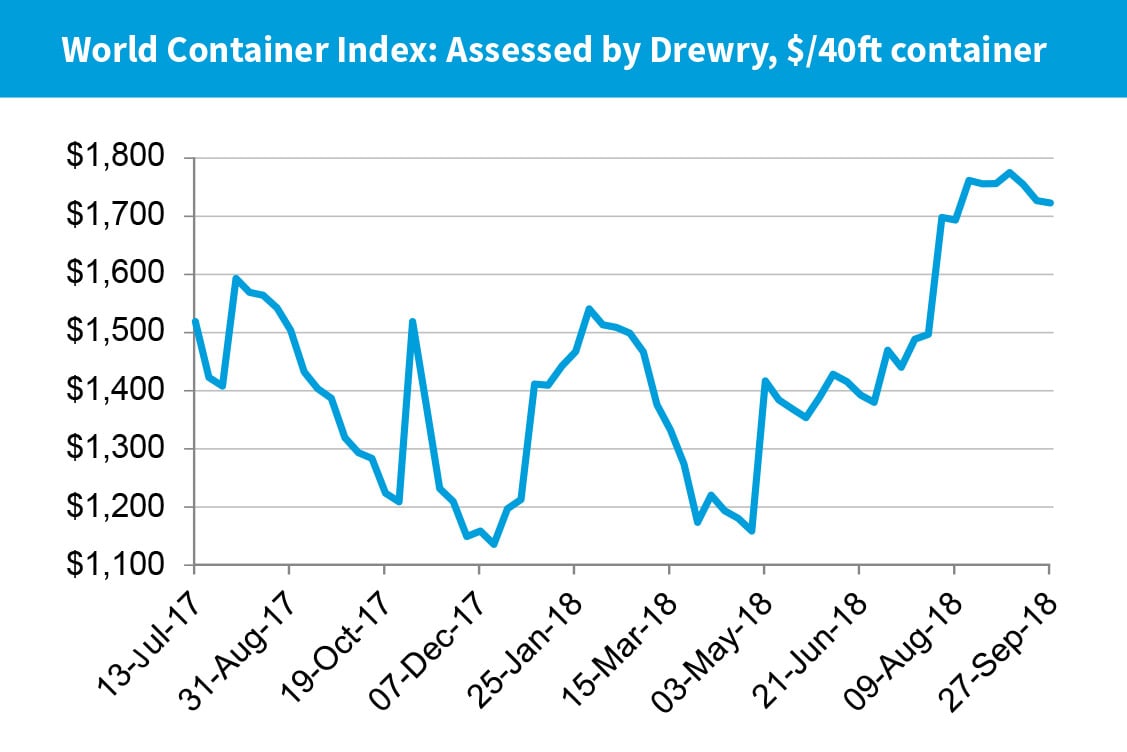

One word that comes to mind when thinking back on the third quarter is “disruption.” And with disruption, comes uncertainty. Such unpredictability is not uncommon within the shipping industry; rather, you might say this sector is defined by periods of varying degrees of ambiguity: how trade policies on one side of the world will ripple through to affect rates on the other, how regional conflicts can seismically dictate supply and demand, how global economic homeostasis or destitution can, quite literally, sink ships. Each possesses the power to alter the overall balance of this delicate ballet.

Despite these inherent characteristics, however, shipping, similar to other sectors, finds itself at an exceptionally distinct moment due to the recently implemented $200 billion in tariffs targeting China and tough rhetoric from the U.S. government throughout the past several months threatening even more. Talk (and tweets) regarding this ongoing “trade war,” consequentially substantial shifts in tariffs, specifically those aimed at China, and other equally seismic alterations associated with protectionism have dominated the industry. This removes us from a “normal” scenario and sets us afloat toward lesser-charted, possibly turbulent waters into the fourth quarter—typically our peak and choppier period. What will the next round of tariffs from the White House be? And what will be its ramifications?

These are questions that we inside the industry have been asking ourselves, too. The fact of the matter is, we simply do not know. Regardless, we must, as the saying goes, hope for the best but be prepared for the worst. How do you do that? With experience. With insight. With a dedicated team committed to ensuring the very best for clients. With the confidence that you’ve recruited the very best supply chain management in the industry, one that’s anticipating every variable affecting the sector. That’s CAF Worldwide.

We will continue to monitor the situation, and continue to provide unprecedented freight forwarding and logistics services to our clients, no matter the seas ahead.

Feedback from industry partners and overseas offices suggest cargo space will open up around October 15, which should ameliorate some capacity crunch woes.

Although too soon to know its exact ramifications, the trade war and associated tariffs have the potential of crippling global trade, despite an otherwise growing worldwide economy.

The U.S.-initiated tariff battle can also have the effect of unifying the affected nations to counterbalance the possibility of limited American trade.

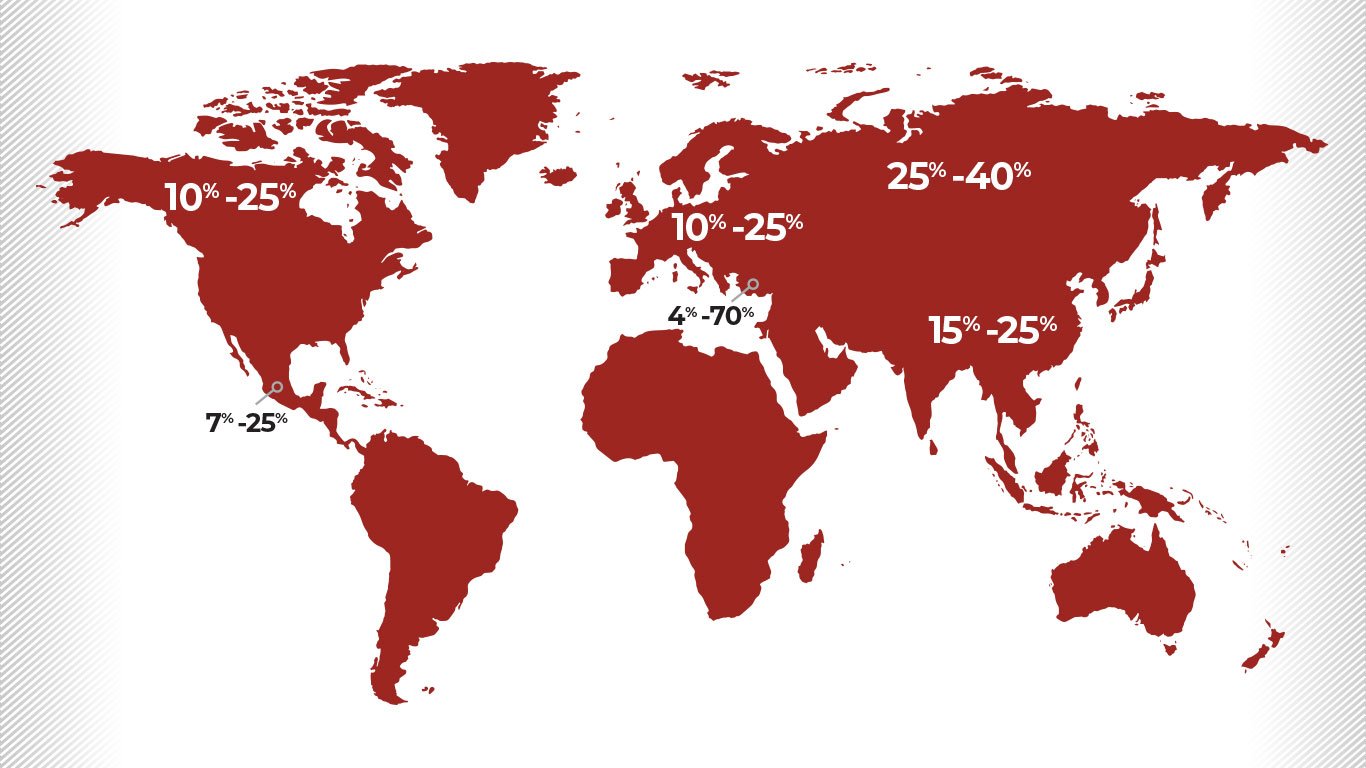

The third round of U.S.-China tariffs was approved with a 10% duty on goods, to increase to 25% in January 2019. China responded with 5-10% tariffs on $60 billion of U.S. exports. The U.S.-led tariff war has also sparked significant retaliatory duties from nations across the globe, which will have dramatic-yet-unclear effects on worldwide trade, through the fourth quarter and beyond.

Russia

25-40% additional duties on certain types of goods from the U.S. effective August 6.

European Union

10-25% additional duties on 3.2B in U.S. goods effective 6/22 with plans to impose 10-50% additional duties on another 4.2 B in US goods as of June 1, 2021.

Mexico

7-25% additional duties on 3.6B in U.S. goods imposed in two tranches, effective June 5 and July 5.

China

15-25% additional duties on 3B in U.S. goods effective April 2.

Canada

10-25% additional duties on 12.7B in U.S. goods effective July 1.

Turkey

4-70% additional duties on 1.8B in U.S. goods effective June 21.

Handbags, hats, and leather and fur clothing and accessories are just some of the targets within the apparel and footwear sectors affected by U.S. tariffs, with many major retailers and suppliers throughout the global supply chain fearing more goods will be added to the growing list.

Hundreds of U.S. companies, including the world’s largest retailer, Walmart, Target, and more than 50 shoe brands, including Nike, Adidas, Crocs, and DSW, among others, have conveyed opposition to the Trump administration’s tariffs.

Published Sept. 20, 2018

Published Sept. 20, 2018“Already chaotic and upended, the Trump administration’s proposed Jan. 1 25 percent tariff on imports from China is causing importers to scramble for ocean, truck, and rail capacity—with the next ramification being the warehouse variable: Will there be any space after the front-loading of imports?”

CAF was founded in 1982 with a vision to be an industry leading, full-service logistics provider.

Over the years we have weathered changes in the global distribution landscape by focusing on exemplary customer service and retention that is unparalleled in the freight forwarding industry.

Through the use of technology, experience, and highly trained personnel we provide our customers with the highest level of service and supply chain solutions. Our complete dedication to excellence has remained constant ensuring that our focus on providing the absolute highest quality service to our clients is never diminished.

100 Jericho Quadrangle,

Suite 233

Jericho, New York 11753

516-444-3700