Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

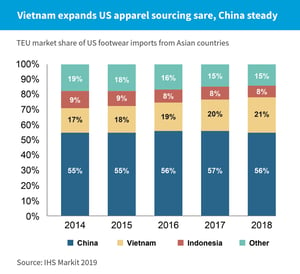

Gradual migration of supply chains out of China in favor of Southeast Asia began long before President Donald Trump began slapping tariffs on Chinese goods. Cambodia, Vietnam and Bangladesh, for example, have all experienced tremendous trade growth, relatively speaking, throughout the last decade or so, with Washington’s recent penchant for utilizing tariffs as its main negotiating tool further exacerbating the associated supply chain consequences.

With more than $250 billion in tariffs already imposed, and President Trump’s proposed plan to place tariffs on all remaining commodities from China creating even more uncertainty, it is difficult to gauge just how worried we should be about blanket duties actually coming into fruition. The Trump administration has been hesitant to pull this additional $300 billion trigger, announcing at the conclusion of June’s G20 summit—a two-day meeting of 19 countries and the European Union (EU) representing most of the world economy—it would hold off on executing this fourth round of tariffs “for the time being.”

Trump has good reason to ease up: Election time is nearing, and this next wave, which would include apparel and footwear, would devastate mega-retailers such as Walmart and Target and affect the ultimate consumer drastically—Middle America, specifically, the president’s powerbase. To date, Trump’s China tariffs have already cost $16 billion in bailouts to burned farmers, whose backing is crucial for Team Trump come election season. A study by the Federal Reserve Bank of New York suggests 2018 tariffs have cost the average household $419 annually.

No matter the escalation and duties ultimately levied, it’d be impossible to replace the so-called “Sleeping Giant” entirely, but other countries are certainly benefiting from the shift right now. Those for whom a move away is inevitable are advised to reconsider their logistics partnerships, as many forwarders and brokers working out of China are inexperienced in developing Southeast Asian markets. With significantly less-stable infrastructure than China, the importance of well-established relationships in the region cannot be overemphasized.

As always, we will continue to monitor the situation and provide extraordinary freight forwarding and logistics services to our clients, no matter the seas ahead.

As aforementioned, it’s important to recognize that supply chain shifts away from China were already in the works, yet on a less-immediate time frame. Companies were already moving out because trade there was getting expensive with or without new tariffs. Now, however, for supply chains to continue operating within budgets, there is no choice but to look outside its borders—an urgency propelled by the constant threat of tariffs. Trump’s trade war is simply creating an environment where the inevitable is occurring sooner rather than later.

At CAF Worldwide, we’ve had several customers who’ve already moved small pieces of their supply chains to Cambodia, Vietnam or Bangladesh, depending on their commodities. Longer-term, we’re talking with supply chain managers who will be moving as much production as they can—again, depending on the commodity.

The key for these supply chains right now is to pay close attention to their service providers. What we’re seeing is an eagerness to move supply chains around, but an uncertainty about where exactly to go. If you’re using a freight forwarder out of China and now trying to work in Central America or Southeast Asia, that provider might not be the best choice for you.

Oftentimes, importers work within very specific niche markets, so we’ve also had people reaching out to us looking for capacity within these. We anticipated this. Everybody is moving their suppliers to other markets, where they don’t have a lot of contacts, so they’re struggling with unprecedented issues pertaining to space. Many forwarders work exclusively out of China and the United States. If you are going to work with one of these forwarders that has no infrastructure within the markets you are trying to break into, you are going to struggle—there’s just no two ways about it.

That’s not to say these forwarders are incompetent. Most still in business today following the major shakeout during the last decade and hyper-competitive markets of recent years are more than capable, but forwarders have decidedly distinctive strengths. For example, while one may be fantastic in China, if you move to Vietnam, it might not have a good office there, might not have contracts there, might not have enough volume there. That makes it difficult to provide the same level of service. It’s not to say it’s not a good company, it’s just that certain lanes may not be in their wheelhouse, so to speak.

Bangladesh, for instance, is one of the most difficult markets in the world, logistically, but its labor costs are significantly cheaper than in China, and the country is known to produce high-quality goods—cotton, specifically. If you do not work in Bangladesh, and you have a client who moves there, you’re not going to be successful right away. Cambodia is similar in that way. Its infrastructure leaves much to be desired, and the same can be said of its port systems. All other things being equal, if you do not know the right people or have the right contacts, it can be very challenging, if not downright defeating.

“Footwear is a funny thing—it’s highly specialized, so it’s one of the harder commodities to move out of China, because they have the technical knowledge and manufacturing capabilities, but Vietnam has been creeping up on them.”

In May, President Trump threatened to impose tariffs on all goods imported from Mexico beginning at 5% and increasing another 5% each month before reaching their peak at 25% in October. The threat was retracted soon after, with President Trump citing an agreement regarding immigration legislation as the reason.

Additionally, in May, the Trump administration warned the EU about potential levies to be placed on imports, worth about $21 billion. A decision is expected regarding $7 billion in EU tariffs by summer’s end.

Mexico

EU

In our last report, we covered proposed automation at the Port of Los Angeles regarding reefer containers, a project that remains ongoing. A recent report by Moody’s Investors Service predicts automation not only implemented for high-risk reefer containers, but also high-volume gateways in North America and Europe that generate local as well as discretionary transshipment cargo.

The need for automation is necessitated by growing vessel sizes and container exchanges. Mega-ships call for the ability to stack containers higher and higher, without loss of productivity.

“With the ability to deliver multiple benefits beyond labor savings, we expect adoption of automation to increase, both globally and in the U.S. and Canada,” states Moody’s June 24 report.

While automation at major ports certainly presents political and social risks, it is important to note that only 3% of about 1,300 container terminals worldwide have been automated. For the most part, longshoreman jobs and labor unions are not under siege.

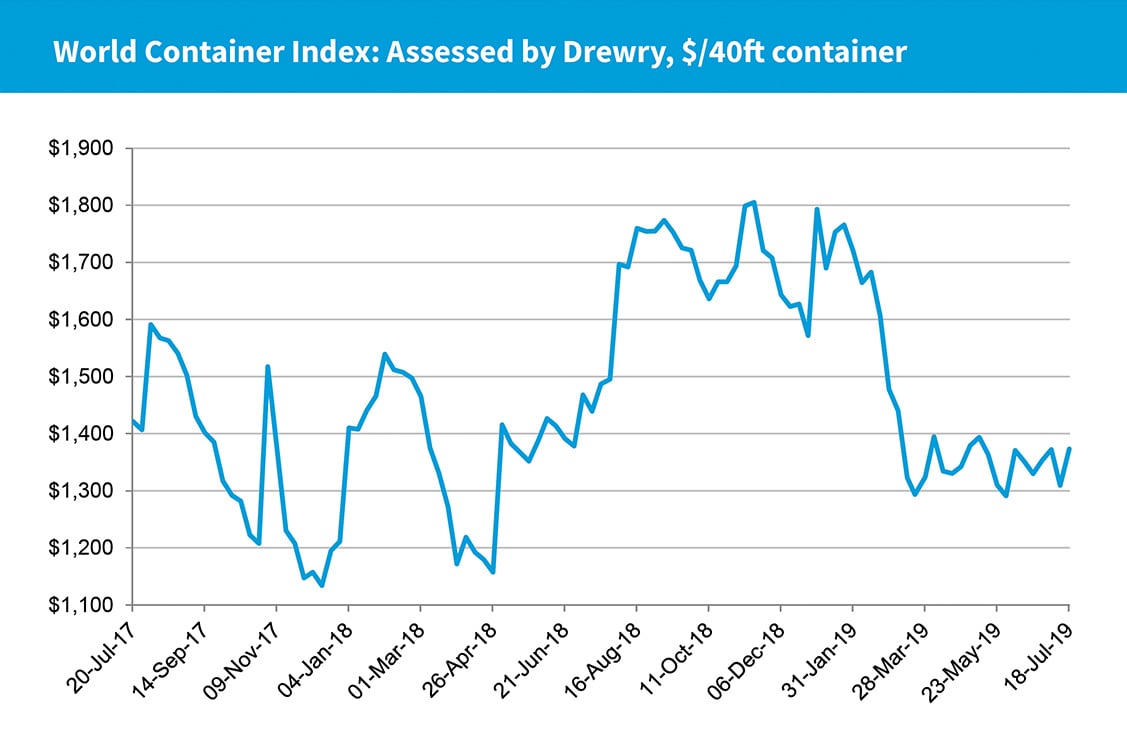

Some developments in 2018 and through the first half of 2019 hint at carrier behaviors moving toward strategies leveraging the novel carrier oligopoly of recent years to more directly benefit carriers.

The majority of all capacity on east-west trades is controlled by just three alliances. Carriers are getting better at manipulating supply by withdrawing capacity, with the goal of increasing freight rates.

Our advice to shippers: Rethink your procurement strategies, and plan for blank sailings when negotiating contracts... or let CAF Worldwide do it for you.

As previously stated, carriers are not shying away from using blank sailings to curtail capacity growth. Carriers expect a weak peak season due to the ongoing tariff dispute, so blank sailings in the trans-Pacific should be expected.

Significant unresolved issues continue to impact and dictate such growth, chief among these, ongoing uncertainty regarding trade tensions between the United States and China—with threats of an additional $300 billion in tariffs on nearly all remaining Chinese imports, including apparel, weighing heavy on the minds of retailers and freight forwarders alike. The U.K.’s impending departure from the EU without a transition agreement—referred to as a so-called “no-deal” Brexit—along with weakened business confidence, the tightening of financial conditions in emerging markets and advanced economies, and higher policy uncertainty across many economies, are other associated concerns.

Alternately, stimulus efforts by China, global central bank loosening, and a meaningful trade resolution between the United States and China could nullify the negative effects of the current tariff war, or at least help move closer to economic equilibrium.

Other key pieces of the puzzle include:

New NAFTA

Trade Tensions

Container Trade

CAF was founded in 1982 with a vision to be an industry leading, full-service logistics provider.

Over the years we have weathered changes in the global distribution landscape by focusing on exemplary customer service and retention that is unparalleled in the freight forwarding industry.

Through the use of technology, experience, and highly trained personnel we provide our customers with the highest level of service and supply chain solutions. Our complete dedication to excellence has remained constant ensuring that our focus on providing the absolute highest quality service to our clients is never diminished.

100 Jericho Quadrangle,

Suite 233

Jericho, New York 11753

516-444-3700

Copyright 2025 CAF Worldwide. All rights reserved. Accessibility Statement

Copyright 2025 CAF Worldwide. All rights reserved. Accessibility Statement